Adverse Selection Is a Concept Best Described as

Adverse selection refers to a situation where sellers have more information than buyers have or vice versa about some aspect of product quality. An employer is practicing adverse selection when it has approaches or policies that lead to negative or unfavorable treatment toward a person or a group of people who are in a protected group such as women or minorities.

Adverse Selection Definition How It Works Practical Example

It describes a situation where an individuals demand for insurance is positively correlated with the individuals risk of loss.

. Non-smokers typically live longer than smokers. Adverse selection is a common scenario in the insurance sector. This can be illustrated by the link between smoking status and mortality.

Adverse selection can happen at any point in the employment process such as hiring training promotions transfers and layoffs. The term adverse selection was originally used in insurance. 3 Adverse selection is a problem associated with equity and debt contracts arising from A the lender s relative lack of information about the borrower s potential returns and risks of his investment activities.

Adverse selection refers to a situation when there is asymmetric information prevailing in the market before the insurance have been issued and thereby resulting into undesired result. The concept of adverse selection helps in explaining why the financial system is so heavily regulated why firms obtain more funds from banks and other financial intermediaries rather than from the securities markets and why indirect finance is more important than direct finance as a source of business finance. Adverse selection anti-selection or negative selection is a term used in economics insurance statistics and risk managementIt refers to a market process in which bad results occur when buyers and sellers have asymmetric information ie.

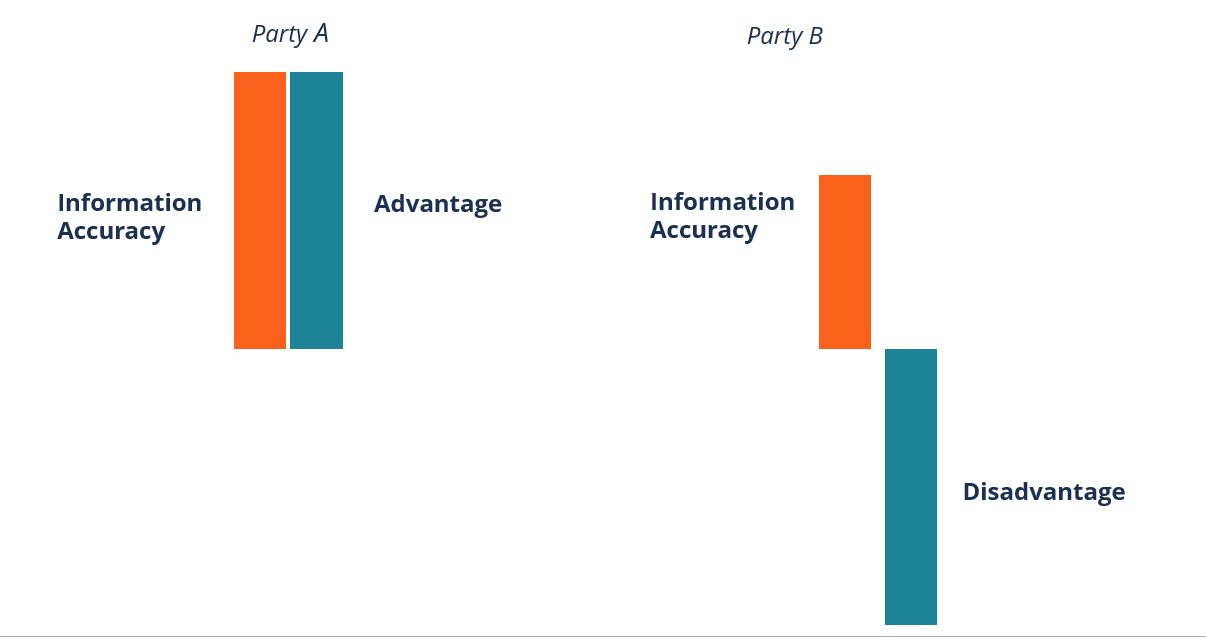

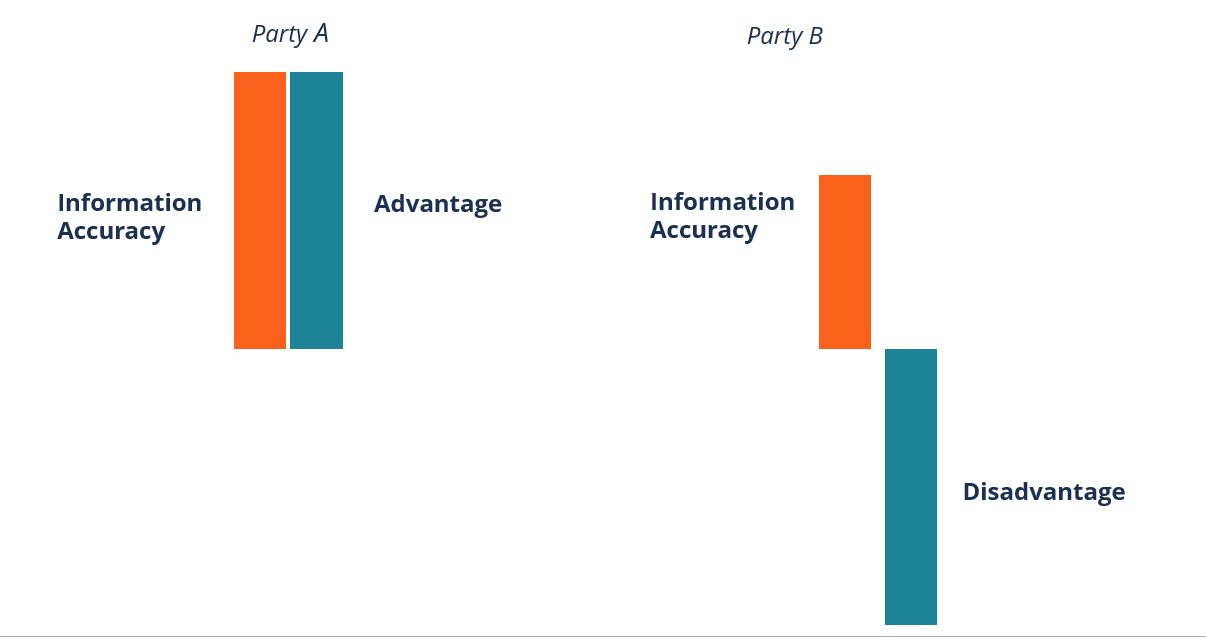

The risk associated with selecting stocks in only a few specific companies. Access to different information. The result is that participants with key information might participate selectively in trades at the expense of other parties who do.

After obtaining insurance a. Adverse selection also called antiselection term used in economics and insurance to describe a market process in which buyers or sellers of a product or service are able to use their private knowledge of the risk factors involved in the transaction to maximize their outcomes at the expense of the other parties to the transaction. Risks with higher probability of loss seeking insurance more often than other risks.

Commercial Insurance Broker A commercial insurance broker is an individual tasked with acting as an intermediary between. More Nonstandard Auto Insurance. A groups reported losses are more likely to become equal to the statistical probability of loss The larger group.

Adverse selection refers to the tendency of high-risk individuals obtaining insurance or when one negotiating party has valuable information another lacks. Adverse selection is a concept best described as Risks with higher probability of loss seeking insurance more often than other risks Adverse selection means that there are more risks with higher probability of loss seeking to purchase and maintain insurance than the risks who present lower probability. In economics insurance and risk management adverse selection is a market situation where buyers and sellers have different information.

The risk that a person will become overconfident in his ability to select stocks. Resolving Adverse Selection in the Health Insurance Industry Adverse selection is an important concept in the fields of economics as well as insurance and risk management. Asymmetric information in the market will cause movement in the price and quantity demanded for goods and services in the market.

Adverse selection is an important concept in the fields of economics as well as insurance and risk management. Adverse selection is a concept best described as. The adverse selection can be problematic in the case of the insurance market as the healthy people would dissuade from buying such policies such that the company has to pay high amounts for the sick people who would be buying such policies.

Adverse selection means that there are more risks with higher probability of loss seeking to purchase and maintain insurance than the risks who represent lower probability. Adverse selection means a situation where the buyers and the producers have asymmetric information about a product. A high - risk person being more likely to apply for insurance.

The meaning of ADVERSE SELECTION is a market phenomenon in which one party in a potential transaction has information that the other party lacks so that the transaction is more likely to be favorable to the party having the information and which causes market prices to be adjusted to compensate for the potential unfavorable results for the party lacking the information. B Underwriters slanting the odds in favor of the company. Adverse selection refers to a scenario where either the buyer or the seller has information about an aspect of product quality that the other party does not have.

Adverse selection refers to an event in which one party in a negotiation has relevant information about the situation that the other party lacks and that asymmetry of information leads to a series of bad decisions or choices such as doing more and more business with less profitable or riskier market segments. Adverse selection is a concept best described as A Risks with higher probability of loss seeking insurance more often than other risks. Adverse selection describes circumstances in which either buyers or sellers have information that the other group does not have.

Adverse selection is a concept best described as risks with higher probability of loss seeking insurance more often than other Which statement regarding insurable risks is NOT correct. Underwriters must guard against this. The bad products or services are more likely to be selected.

Sometimes known as anti-selection. Sometimes known as anti-selection Adverse selection describes circumstances in which either buyers or sellers use information that the other group does not have specifically about risk factors related to a particular business.

Bulletjournaling Etudier Dur Prise De Notes Etude

Adverse Selection Definition 3 Examples And 4 Effects Boycewire

Contoh Soal Pola Hereditas Dan Kunci Jawaban Beserta Pembahasan Hereditas Atau Pewarisan Adalah Pewarisan Watak Dari Induk Ke Keturunannya Pola Kromosom X

Xuan Shared A Post On Instagram Why Is This So Blurry Tho Anw Thought I Should Post Sth Before I Lose All My Followers Losing Me Thoughts Blurry

Comments

Post a Comment